Top 5 Trends Shaping Warehouse Automation Strategies

Automation

May 29, 2024

Automation

May 29, 2024

A changing regulatory landscape, heightened customer expectations, and the promise of developing technologies all have their roles to play in the evolution of warehouse-based logistics. The top five challenges that businesses are facing today include a mix between some longstanding struggles as well as new areas for opportunity. Read on to learn which trends made our list and how we predict that they will make their mark on logistics strategies in the near future.

Demand for labor within warehouse and fulfilment environments has been top-of-mind for several years. The twin challenges of sourcing labor and training new hires on solutions are both exerting their influence on the development of packaging solutions.

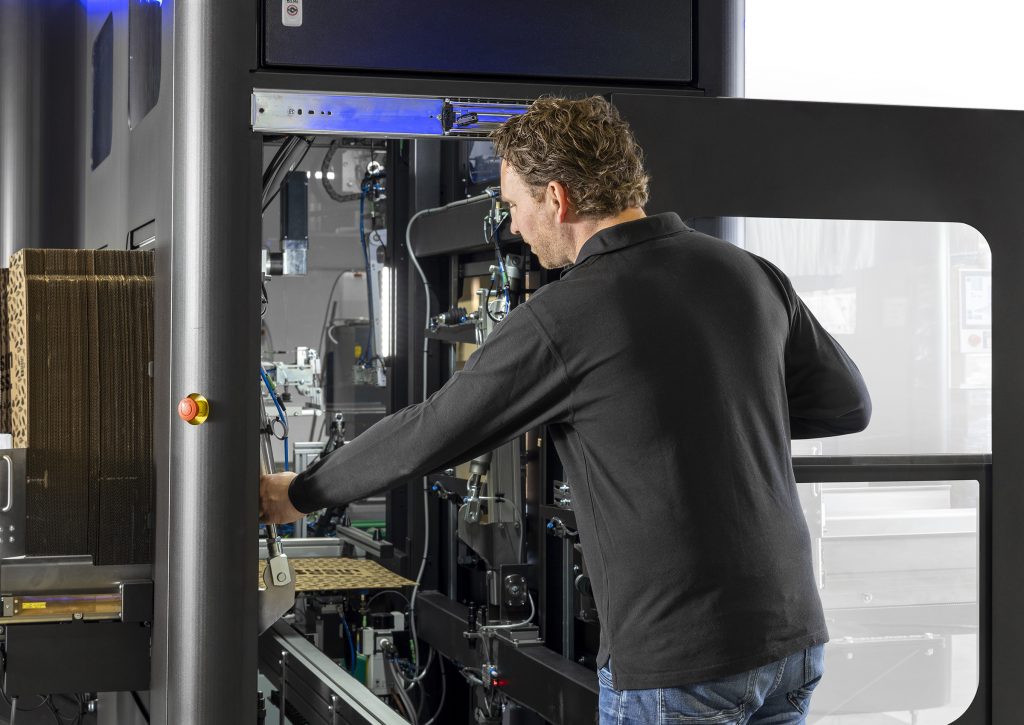

Within automation, this means that solutions are being applied to eliminate the most repetitive tasks within logistics flows, including picking, box erection, label application, height-reduction, and sealing. It also means that the solutions being deployed to automate these tasks must be as simple to operate as possible to satisfy the ongoing labor shortages in today’s market. Within shipping and logistics, fully dark warehouses are very rare and we’re increasingly seeing more and more mixed environments where humans are working alongside automated systems. In this new model, people are typically required for more complex and strategic roles and to ensure machine uptime while automated solutions bring greater efficiency to repetitive tasks. The ability for packers to immediately and intuitively make decisions around more complex problems means that the most effective intralogistics flows typically feature people working in tandem with automation.

Explore the trends influencing pack station evolution

Concepts such as goods-to-person (G2P) picking and packing show how an increasingly automated warehouse can still incorporate human packers and warehouse managers. Human oversight is a critical component, even as the movement of goods is automated with robotic picking systems and conveyors bringing order items and shipping boxes together in an information-rich flow. Systems that pair a single operator with solutions that do the hard work of preparing packages to ship have an amplifying effect on productivity that allows businesses to perform at peak levels without needing to greatly increase their headcounts with temp labor.

Integration of automation technology into both greenfield and brownfield environments hinges on the question of total cost of ownership and how soon these investments can deliver ROI. With the explosion of consumer and business interest in AI, the question that naturally follows is how AI can be integrated into the warehouse and deliver value through what it does best: pattern recognition, rapid ideation, flagging of errors and signaling for preventative maintenance, as well as delivering iterative solutions to key questions. Aside from identifying the strongest applications for AI, challenges for integration include managing data input quality and training the solution while also teaching human employees how to interact with these tools to gain the best results.

Global businesses, including Amazon, are attuned to the role that AI can play in packaging and are seeking to achieve outcomes such as optimizing material usage and decreasing the amount of package sizes and SKUs. Because AI is generally only as good as the data that is used to train it, its role in the warehouse is linked to the connectivity of the solutions that are being used, where it can learn from the high volumes of information that a logistics flow represents. AI-enabled solutions allow businesses to learn about what does and does not work within their current packaging lines, intervene with potentially costly mispacks, and then implement corrective behavior to enhance future performance.

In 2022 the UN Environmental Assembly resolved to pursue a legally binding instrument to end plastic pollution to be negotiated and adopted by 2024. As deliberations continue through the year, the pending legislation could see an increase in regulatory activity around the world as nations work to make good on their commitments.

Some of the strategies on the table for discussion include adoption of Extended Producer Responsibility (EPR), where the costs associated with material collection and recycling are put onto producers instead of the end-consumers of packaging. These laws could increase funding behind collection and recycling programs and incentivize movement towards materials that already have robust recycling rates such as paper and aluminum.

EPR already has a long history in Europe, and it is becoming more well known in the United States, as well. To date, California, Maine, Oregon, and Colorado have already passed their own EPR legislation while nine other states have EPR programs within their legislation pipelines for 2024, with Hawaii working on an exploratory bill that would assess and potentially lay the groundwork for EPR.

Additionally, the EU Packaging Directive is a piece of legislation crafted by the European Commission to reduce waste and improve the recyclability of packaging. Revisions to the Packaging Directive include targets for businesses to improve the sustainability of their packaging, notably the requirement to limit void within packaging to 50% or less by a compliance deadline of 2030.

Learn more about the European Packaging Directive

Between existing regulatory targets and the potential development of new legislation in the near future, businesses around the world are factoring recyclability and right-sizing into their forward plans.

Being able to do more with limited space is not a new challenge for warehouse managers. Even for retail businesses that maintain smaller scale pack stations, the competition for room to operate, room to store products and packaging materials, and space for the converters and machines that facilitate the pack job can be just as significant.

As consumers around the world continue to make online buying a part of their lives after the surge of pandemic adoption, cost pressures relating to warehouse space are likely to remain a key consideration for both established locations and for businesses looking to expand their bases of operations with new sites.

Learn more about warehouse trends in Asia-Pacific

Customers are becoming increasingly reactive to the presentation and consistency of their packaging. When a brand truly nails their unboxing experience, it can become a calling card that keeps customers coming back and even serves as a source of free advertising magnified across social media (or just a community package area, porch, or post-office). Packaging can include internal branding, as well, which can be a good option to increase “surprise and delight” upon opening a package while presenting a lower exterior profile on a porch or stairway when shipping high-value goods to assist with loss prevention.

Tamper-evident packaging, featuring tear strips or perforated lids, plays a role in loss prevention while also making it easier for customers to open their packaging and enjoy the unboxing. On the off chance that they want to make a return, the ability to reseal packaging with tape or integrated adhesive can improve their experience and encourage them to maintain a relationship with a brand they view as respecting their time and facilitating their choices.

Atlanta | March 28 – 31

Visit us at the

Caja Robotics booth: #C3789

You are now leaving the Ranpak website. The website you will be entering is not owned or operated by Ranpak and/or its subsidiaries. The content, products and information contained on third party websites are not owned or controlled by Ranpak and/or any of its subsidiaries. Therefore, Ranpak makes no representations about, does not endorse or adopt, and is not responsible or liable for damages relating to the third party, its products or services, its website, its privacy policies or practices, or the content of the third party website.